Sale of a company

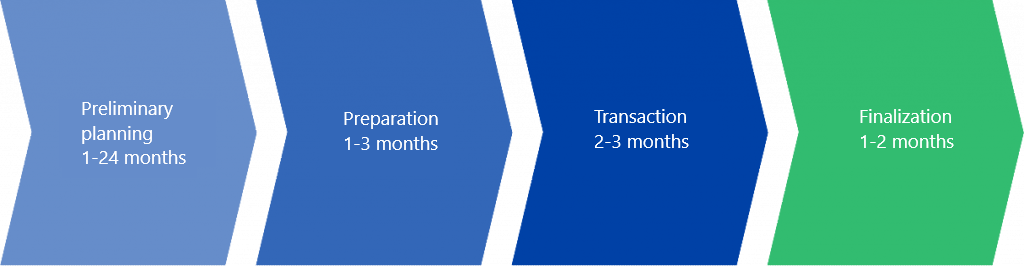

The sale of a company is usually a long process with several stages. The chart below presents the main stages of the process and estimates of their duration.

Preliminary planning

Business analysis

Business analysis refers to a comprehensive analysis of the state of a company. In addition to the financial situation, e.g., the company’s industry, markets, products, and competitiveness is analyzed in order to form a clear view of the company’s current situation and future expectations.

However, financial analysis is the most important aspect of business analysis. It is important to use comparable and restated financial statements in the analysis in order to get the most accurate picture possible of the company’s growth, profitability and liquidity, for example.

The industry analysis is based on the analysis and comparison of the company’s competitors in the industry. The most important output of this comparison is to outline the company’s market position and to map out the strengths and weaknesses of the business.

Valuation

The value of a company is typically determined in connection with an acquisition, share issue or redemption of a minority interest. The subject of the valuation may be the share capital or the business. There is no absolute fair value to a company, but it depends on the stage of development of the company, the valuation methods used, and the purpose for which the valuation is made. Valuation methods can be based on returns, net asset value, future cash flows, or comparable prices.

The return-based value is calculated using coefficients derived from the income statement, in which case it is good to use profit averages based on both history and forecasts. This provides a more realistic estimates of the value of the business.

Net asset value is obtained by separating the company’s assets and liabilities. The valuation made directly on the basis of the balance sheet corresponds to the mathematical model from the tax legislation, but a more realistic picture of net worth is obtained by taking into account the market values of balance sheet items and off-balance sheet liabilities.

Different methods give different estimates of the value of a company, and in most cases the best theoretical result is obtained by discounting the future cash flows to their present value. However, in the absence of reliable forecasting methods, key figures and various multipliers are commonly used in SMEs.

Preparatory measures

Preparatory measures cover both the owner’s and the company’s preparation for the acquisition.

Preparing the owner for the acquisition means identifying possible successor options and preparing the owner mentally to give up the business. For many entrepreneurs, a business is a life’s job that can be very difficult to give up. However, finding a suitable successor and thus, a clearer view of the continuation of the business going forward can make the transfer easier.

Preparing the company for acquisition may include e.g. reorganization of the company’s personnel and changes in responsibilities, recruitment and training, and disposals of non-operating balance sheet items. The aim is to make the company a more attractive to buyers and to make post-acquisition takeover and business continuation easier.

Preparation

Transaction structure

The most common methods of implementing an acquisition are purchase of shares and purchase of business operations. The choice of implementation method is influenced by, for example, the balance sheet structure of the company to be sold, the tax effects of the acquisition and whether the company is being sold in whole or in part.

In a share transaction, the buyer explicitly receives shares of the selling company in exchange for the purchase price. If the transaction concerns the entire company, all obligations are transferred from the seller to the buyer as a result of the transaction. The shares can be paid in cash, in shares of the purchasing company, as a share exchange, or a combination of these.

In a business operation transaction, the balance sheet assets related to the business operations and the employees are transferred to the buyer. However, the company’s debts and liabilities do not pass on to the buyer. For this reason, the buyer often favors purchasing the business operations, while the seller prefers share transaction.

Buyer mapping

Mapping potential buyers is an important part of a company’s sales. The first step in identifying buyers is to define criteria. These are materially affected by the value, industry, visibility and significance of the company in its industry, products and services, marketing and distribution channels, and ownership structure and organization. The goal is to find potential buyers for whom the company offers the most business benefits, so that the purchase price, naturally, can increase.

A suitable buyer candidate may already be known to the seller, in which case the mapping of buyers is not required if the transaction is completed with that buyer. The seller can also pre-assign buyers to the banned list, in which case they will not be contacted.

Price determination

The price of a company depends on many factors, and the value and price of a company are not very often the same thing. In addition to the value of the company, the price is affected by, for example, the negotiating positions of the buyer and the seller, the financial positions of the parties and the general financial situation. The owner must therefore determine the price for his business, but the final price will be determined in negotiations between the seller and the buyer.

Transaction

Negotiations

The negotiation phase begins with the signing of the non-disclosure agreement. After that, the name of the company and more detailed information about the company can be shared with the buyers, and the buyers commit to keeping the shared information confidential. At this stage, negotiations are underway with several candidate buyers.

Negotiations become more concrete when they are based on the buyer’s initial offer and a timetable is agreed. Although the negotiations create a basis for trust between the seller and the buyer, the issues discussed in the negotiations should be carefully documented from the beginning.

Letter of intent

As a result of the negotiation phase, a letter of intent is made, in which e.g., the subject of the transaction, the structure of the transaction, the purchase price and its terms of payment, other terms of the contract and the schedule are determined. The conditions for the transaction to be completed are also recorded in the agreement. In connection with the letter of intent, peace of negotiation is agreed with the selected buyer, in which case negotiations with other buyers will no longer take place. Sometimes the acquisition is negotiated and completed without a letter of intent.

Finalization

Due diligence

Due diligence (DD) means a thorough inspection of the target of the acquisition before the transaction is completed. The audit includes a financial, tax and legal/contractual review of the company and a comprehensive analysis of the business. It is a good idea to outsource the inspection to experts.

DD inspection is more important measure for the buyer, as the buyer wants to be certain of the purchase and avoid any surprises after the transaction. However, it is also a good idea for the seller to perform an inspection to know exactly what is being sold.

It is advisable to scale the DD audit according to the size of the company, the scope of its operations, its internationality and the assessed risks. The process should be carefully planned and given sufficient time.

Buyer's financing

An acquisition rarely takes place without outside financing, and often the amount of the buyer’s equity is a limiting factor in the size of the transaction. Although obtaining financing for an acquisition is a process between the buyer and the financiers, it is also good for the seller of the acquisition to know how the buyer will obtain the financing.

Contracts

Once the inspections have been completed and the financing of the acquisition is clear, the acquisition is ready to be completed. A purchase and sale agreement (PSA) is drawn up and signed for the transaction, and other agreements are signed, if necessary, such as a shareholder agreement in connection with a management buyout.

Interested in selling your company? Contact us.