Preparing for the sale of a company

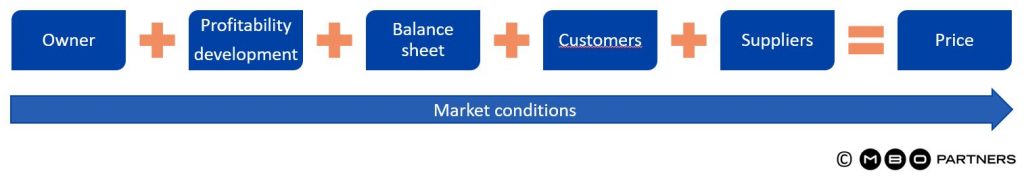

Key factors affecting a company’s purchase price

In acquisitions, the role of the owner is significant. The more dependent a company is on its owner, the more difficult it is to sell or otherwise transfer ownership. The same goes for the price you get in an acquisition: The value of a business that depends on its owner decreases when the owner changes. In turn, costs that weaken the short-term profitability arise from the reorganization of personnel, training and possible recruitment, which are almost invariably caused by a change in ownership and the transfer of responsibilities. It is therefore advisable for the owner to start preparing the acquisition in time.

It is also necessary to go through the company’s assets. Are there any non-business assets in the company’s balance sheet? Is the buyer willing or able to purchase all the balance sheet items? There are ways and techniques to edit your balance sheet which you should discuss with an expert.

The company will get the best price when the acquisition is made in an emerging market and the company has evidence of good profitability. In times of weak economy, the purchase price may be lower, but so are the prices of the various investments in which the assets released in the trade can be invested. The company’s profitability development and market position are the main factors affecting the company’s value and attractiveness.